Searching the Financial Service Providers Register

Your search options and the information we hold about financial service providers

You can search the FSPR to identify financial service providers (FSPs) and find information about them — such as which services they're registered for and, if applicable, are licensed or certified to provide.

In this guide:

How to search

Enter any of the following details in the search field to search for an FSP.

- Name

Their current or previous name, trading name or alias. - Registration number

Their FSP number or (if applicable) their New Zealand Business Number (NZBN).

Advanced search options

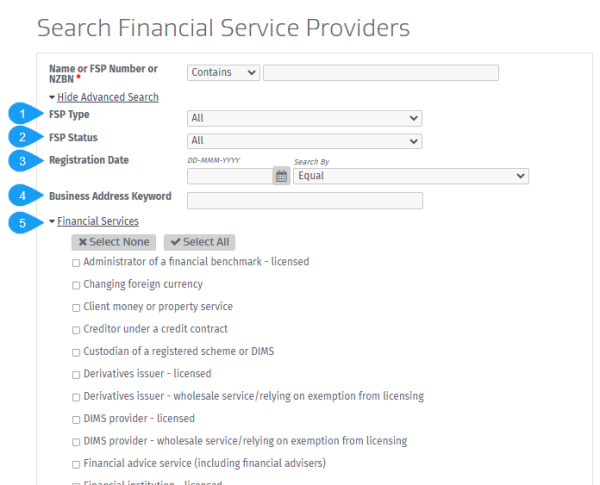

You can use the advanced search to find specific results for:

- Types of FSPs

For example search only for individuals or only for entities, such as companies. - The status of an FSP

For example search only for FSPs that are registered or that have been suspended or deregistered. - FSPs registered on certain dates (or between two specific dates).

- Keywords within a business address

For example by including a street name or a city. - Financial services that FSPs are registered to provide.

When you select this option, choose from the list of possible services.

You can combine different fields to narrow down your results.

Search for a financial service provider

Search for a financial service provider

Information available to you

Once you’ve found the FSP you’re looking for, you can view their details including:

- General details

- Registration date and current status

- Trading name and former trading name, if any

- Other names an individual FSP is known by

- Addresses

- Business address

- Financial services

- Services the FSP is registered, licensed or certified to provide

- The dispute resolution scheme(s) the FSP belongs to, if any (see below for more details)

- The Financial Advice Provider a financial adviser is engaged by and vice versa, if applicable.

Searching for dispute resolution schemes

If an FSP offers financial services to retail clients (for example, a financial adviser) they must belong to an approved dispute resolution scheme (DRS).

You can find out which scheme they belong to when you search this register.

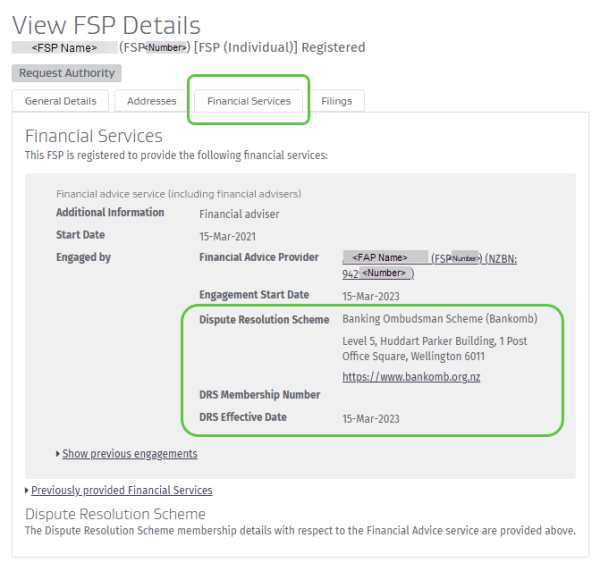

- Once you have found the FSP, select their name to view their full details.

- Select the ‘Financial Services’ tab and see details of:

- each financial service the FSP is registered to provide, and

- which dispute resolution scheme(s) they belong to (including the address of the DRS and a link to their website).

Saving your search results

You can save up to 1000 search results by exporting them in an Excel file format. For each search you complete the file includes the search criteria you used and contains a list of FSPs showing their:

- FSP Name

- Registration number

- NZBN (if applicable)

- Registration status

- Registration date

- Deregistration date (if applicable).

Other guides in

Getting started on the register

- Preparing to register as a financial service provider

- Setting up your online services account

- Using your online services account dashboard

- Confirming your authority to update information

- Keeping financial service provider (FSP) details up to date